A PROJECT REPORT ON “CUSTOMER SATISFACTION TOWARDS RELIANCE MUTUAL FUNDS- SHIMLA”

ACKNOWLEDGEMENT

To carry out

this research work I have got help from my parents who have given full support to carry

out this research

work

It is my

privilege to express my indebtedness to respected teachers, parents, and friends without that help, this project

could not have been completed. Their able guidance, encouragement, and valuable

suggestions led my way pass easily

through a most difficult period

of the project.

Further, I would like to thank my guide Mrs./Mr.

for his guidance & concern, without which it would not have

been possible for me to complete this project.

I am highly indebted to the members of the faculty for the constant encouragement, valuable suggestion & requisite information & documents that were valuable for the completion of the project.

Date……….

DECLARATION

I hereby, . ......declare that I have done the training report on the topic “THE STUDY OF CUSTOMER

SATISFACTION TOWARDS RELIANCE

MUTUAL FUNDS

AT SHIMLA” is submitted in partial fulfillment of the requirements for the degree of MASTERS IN BUSINESS ADMINISTRATION in HIMACHAL PRADESH TECHNICAL UNIVERSITY. It is declared that it has an original piece of work& is worthy of the consideration for the degree of MBA.

~ Index |~

|

SNO |

TITLE |

PAGE NO |

|

CHAPTER-1 |

||

|

1.1 |

Industry profile |

7 |

|

1.2 |

Company profile |

10 |

|

1.3 |

History of reliance on the company |

11 |

|

1.4 |

About reliance mutual fund |

12 |

|

1.5 |

Vision and mission statement |

13 |

|

1.6 |

Reliance vision fund |

14 |

|

1.7 |

Organizational hierarchy |

16 |

|

1.8 |

Organizational structure |

18 |

|

1.9 |

Product profile |

19 |

|

1.10 |

Reliance media

& entertainment fund |

23 |

|

1.11 |

Functional departments |

24 |

|

1.12 |

Functions of the finance department |

24 |

|

1.13 |

Job description of people in the finance department |

25 |

|

1.14 |

Administrative officer (finance) |

25 |

|

1.15 |

Sales department |

27 |

|

1.16 |

Marketing activities in reliance on mutual fund |

28 |

|

1.17 |

HR Department |

30 |

|

1.18 |

HR structure |

31 |

|

CHAPTER-2 |

||

|

2.1 |

Research

methodology |

34 |

|

2.2 |

Need for the

study |

34 |

|

2.3 |

Data collection |

35 |

|

2.4 |

Importance of this study |

36 |

|

CHAPTER-3 |

||

|

3.1 |

Data analysis and interpretation |

38 |

|

3.2. |

Classification of respondents

on the basis of awareness |

39 |

|

3.3 |

Classification of respondents

on the basis of highly-volatile market |

40 |

|

3.4. |

Classification of respondents

on the basis of satisfaction with the different |

41 |

|

3.5. |

Classification of respondents on the basis of investing money |

42 |

|

3.6. |

Classification of respondents on the

basis of ever |

43 |

|

3.7. |

If yes, in which type of funds of mutual fund do you want to invest |

44 |

|

3.8. |

Which are the primary source of your knowledge about mutual funds |

45 |

|

3.9. |

Classification of respondents

on the basis of how to do

you |

46 |

|

3.10. |

Classification of respondents on the

basis of when you |

47 |

|

3.11 |

Classification of respondents on the

basis of which mutual funds |

48 |

|

CHAPTER-4 |

||

|

4.1 |

Findings |

50 |

|

|

|

|

|

4.2 |

Conclusion |

51 |

|

4.3 |

Suggestions |

52 |

|

BIBLIOGRAPHY |

||

|

ANNEXURE |

||

|

QUESTIONNAIRE |

||

1.1 INDUSTRY PROFILE Introduction

A mutual represents a vehicle for collective investment.

Till 1986, the Unit Trust of India was the

only mutual fund in India. Since then public sector banks and insurance

companies have been allowed to set up

subsidiaries to undertake mutual fund business. So, State Bank of India, Canara Bank, LIC, GIC, and a few

other public sector banks entered the mutual fund industry.

In 1992, the mutual fund industry was opened to the private

sector, and a number of private sector

mutual funds such as Birla Mutual

Fund, DSP Merrill Lynch Mutual Fund, Kotak Mahindra

Mutual Fund, Morgan Stanley Mutual Fund, Tata Mutual Fund, Prudential ICICI Mutual Fund, Reliance Mutual Fund,

Standard Chartered Mutual Fund, Templeton Mutual Fund, IDBI- Principal Mutual Fund have been set up. The process

of consolidation began in recent years.

At present, there are about 30 mutual funds managing

nearly 1000 schemes. While the mutual fund

industry in India has registered a healthy growth over the last 15 years, it is

still very small in relation to other

intermediaries like banks and insurance companies. Mutual funds are one of the best investments ever

created because they are very cost-efficient and very easy to invest in. by pooling money together

in a mutual fund, investors can purchase stocks or bonds with much lower trading costs than if they tried to do it

on their own. But the biggest advantage

of mutual funds is

diversification.

The mutual fund industry in India started in 1963 with

the formation of Unit Trust of India, at the

initiative of the Government of India and Reserve Bank of India. The history of

mutual funds in India can be broadly divided

into four distinct

phases

First Phase

- 1964-1987

Unit Trust of India (UTI) was established in 1963 by an

Act of Parliament. It was set up by the

Reserve Bank of India and functioned under the Regulatory and administrative

control of the Reserve Bank of India.

In 1978 UTI was de-linked from the RBI and the Industrial Development Bank of India (IDBI) took over

the regulatory and administrative control in

place of RBI. The first scheme launched by UTI was Unit Scheme 1964. At

the end of 1988, UTIs had Rs. 6,700 crores of assets

under management.

Second Phase -

1987-1993 (Entry of Public Sector

Funds)

1987 marked the entry of non-UTI, public sector mutual

funds set up by public sector banks and

Life Insurance Corporation of India (LIC) and General Insurance Corporation of

India (GIC). SBI Mutual Fund was the first non-UTI Mutual Fund established in June 1987 followed

by

Can bank Mutual Fund (Dec 87), Punjab National Bank

Mutual Fund (Aug 89), Indian Bank Mutual Fund (Nov 89), Bank of India (Jun 90), Bank of Baroda Mutual Fund (Oct 92). LIC

established its mutual fund in June 1989 while GIC had

set up its mutual fund in December 1990.

At the end of 1993, the mutual fund industry had assets

under the management of Rs. 47,004 crores.

Third Phase -

1993-2003 (Entry of Private Sector

Funds)

With the entry of private sector funds in 1993, a new

era started in the Indian mutual fund industry,

giving the Indian investors a wider choice of fund families. Also, 1993 was the

year in which the first Mutual Fund

Regulations came into being, under which all mutual funds, except UTI, were to be registered and

governed. The erstwhile Kothari Pioneer (now merged with Franklin Templeton) was the first private

sector mutual fund registered in July 1993.

The 1993 SEBI (Mutual Fund) Regulations were substituted

by a more comprehensive and revised Mutual Fund Regulations in 1996. The industry

now functions under the SEBI (Mutual Fund) Regulations

1996.

The number of mutual fund houses went on increasing,

with many foreign mutual funds setting

up funds in India, and also the industry has witnessed several mergers and

acquisitions. As of the end of

January 2003, there were 33 mutual funds with total assets of Rs. 1, 21,805 crores. The Unit Trust of India with Rs.

44,541 crores of assets under management was way ahead of other mutual funds.

Fourth Phase -

since February 2003

In February 2003, following the repeal of the Unit Trust of India Act 1963 UTI was bifurcated into two separate entities. One

is the Specified Undertaking of the Unit Trust of India with assets under management of Rs. 29,835 crores as of

the end of January 2003, representing

broadly, the assets of the US 64 scheme, assured return, and certain other schemes. The Specified Undertaking of Unit Trust of

India, functions under an administrator and

under the rules framed by the Government of India and does not come under

the purview of the Mutual Fund Regulations.

The second is the UTI Mutual Fund, sponsored by SBI,

PNB, BOB, and LIC. It is registered with

SEBI and functions under the Mutual Fund Regulations. With the bifurcation of

the erstwhile UTI which had in March 2000 more than Rs. 76,000 crores of assets under management and with the setting up of a

UTI Mutual Fund, conforming to the SEBI Mutual

Fund Regulations, and with recent mergers taking place among different

private sector funds, the mutual

fund industry has entered its current phase of

consolidation and growth.

Structure of the Indian

mutual fund industry:

The Indian mutual fund industry is dominated by the Unit

Trust of India, which has a total corpus

of Rs700bn collected from more than 20 million

investors. The UTI has many funds/schemes

in all categories i.e. equity, balanced, income, etc. with some being open-ended and some being closed-ended. The

Unit Scheme 1964 commonly referred to as US 64, which is a balanced fund, is the biggest scheme with a corpus of

about Rs200bn. Most of its investors

believe that the UTI is government-owned and controlled, which, while legally incorrect, is true for all practical purposes.

The second-largest category of mutual funds is the ones floated by

nationalized banks. Can bank Asset Management

floated by Canara Bank and SBI Funds Management floated

by the State

Some of the AMCs operating currently are:

|

Name of the AMC |

Nature of ownership |

|

Alliance Capital Asset

Management (I) Private Limited |

Private foreign |

|

Birla Sun Life

Asset Management Company

Limited |

Private Indian |

|

Bank of Baroda

Asset Management Company

Limited |

Banks |

|

Bank of India

Asset Management Company

Limited |

Banks |

|

Can bank Investment Management Services Limited |

Banks |

|

CholamandalamCazenove Asset Management Company Limited |

Private foreign |

|

Dundee Asset Management Company Limited |

Private foreign |

|

DSP Merrill Lynch

Asset Management Company Limited |

Private foreign |

|

Escorts Asset Management Limited |

Private Indian |

|

First India Asset

Management Limited |

Private Indian |

|

GIC Asset

Management Company Limited |

Institutions |

|

IDBI Investment

Management Company Limited |

Institutions |

1.2

COMPANY PROFILE

Introduction

There are a lot of investment avenues available today in

the financial market for an investor with

an investable surplus. He can invest in bank deposits, corporate debentures, and bonds where there is low

risk but low return. He may invest in funds of the companies where the risk is high and the returns are also proportionately high. The

recent trends in the mutual fund market

have shown that an average retail investor always lost with periodic bearish

tends people began for opting for

portfolio managers with expertise. In mutual fund market would invest on their behalf. Thus we have wealth management services provided by many institutions. However, they prove to be

costly for small investors. These investors have found a good shelter with the mutual funds.

Like most developed and developing countries the mutual fund cult is catching on in India

the reason for its interesting occurrence are :

·

Mutual funds make it easy and less

costly for investors to satisfy their need for capital growth income.

· It brings the benefits of diversification and money management to the individual investor, providing an opportunity for financial success that was once available to only a select few.

1.3 History of Reliance Company

The Reliance group founded by Dhirubhai H. Ambani

(1932-2002) is India’s largest private-sector enterprise. He is credited to have brought about the equity cult in India in the

late seventies and is regarded as

an icon of enterprise in India. The Reliance group is a living testimony to his indomitable will, single-minded dedication, and unrelenting commitment to his goals.

The unit trust of India is the first mutual fund set up under

the separate Act UTI ACT in 1963 and started

its operations in 1964 with the issue of schemes US-641. In 1978 UTI was

delinked from RBI and the industrial

development bank of India (IDBI) took over the

regulatory and administrative control in place of RBI.

In the year 1987, public sector banks like the state bank of

India, Punjab national bank, Indian bank, bank of India, and bank of Baroda set up mutual funds.

Apart from the abovementioned banks' life insurance

corporations (LIC) and General Insurance Corporation have set up mutual funds. LIC established its mutual funds in june1989 while gig had set up its mutual funds in

December 1990. The mutual fund industry had assets under the management of RS 47,004 crore. With the entry of private

sector funds, a new era has started in the mutual

fund industry. e.g. Principal mutual fund.

1.4 About Reliance mutual funds

Reliance mutual funds are one of India’s leading

mutual funds with average assets under management

of Rs. 1,12,914 crores (April 14 – June 14 quarter ) and 52.69 Lakhs folios. (30thjune 2014).

Reliance mutual fund is a part of the reliance group one

of the fastest-growing mutual funds in India.

RMF offers investors a well-rounded portfolio of products to meet varying

investors' requirements and has

a presence in 179 cities across the country Reliance mutual funds constantly endeavor to launch innovative products and customer

service initiatives to increase

value to investors. Reliance capital asset management limited (RCAM) is the set manager

of the reliance mutual fund. RCAM is a subsidiary of reliance capital

limited (RCL).

Presently, RCL holds Up to 65.23% of its total issued and

paid-up equity share capital, and the balance

of its issued and paid-up equity share capital is held by other shareholders

which include Nippon life insurance

company (“NLI” ) holding 26% of RCAM’s total issued and paid-up equity share capital. NLI acquired the said 26% shareholding in RCAM on August 17, 2012.

Reliance capital ltd is one of India’s leading and fastest-growing private sector financial services companies and ranks among the top 3 private sector financial services and banking companies in terms of net worth. Reliance capital ltd has an interest in asset management, life and general insurance, private equity and proprietary investments, stockbroking, and other financial services.

|

Sponsor |

Reliance Capital Limited |

|

Trustee |

Reliance Capital Trustee co. Limited |

|

Investment manager |

Reliance Capital Asset

Management Limited |

|

Statutory details |

The sponsor, the trustee, and the investment manager are in corporate under the companies act 1956. |

1.5

Vision and mission statement

Vision statement

To be a globally respected wealth creator with an emphasis on customer care and a culture of good corporate governance.

Mission statement

To create and nurture a world-class high-performance environment aimed at delighting our customers.

Corporate Governance

Reliance capital asset management limited

has a vision of being a leading

player in the mutual fund business and has

achieved significant success and visibility in the market.

However an imperative part of growth and visibility is adherence to good conduct in the marketplace .at Reliance Capital Asset Management limited the implementation and observance of ethical processes and policies have helped us in standing up to the scrutiny of our domestic and international investors.

Key product and services

The aim of growth funds

is to provide capital

appreciation over the medium to

long term Such schemes

normally invest a major part of their corpus in equities such funds have comparatively high risks. These schemes

provide different options

to the investors like dividend option capital appreciation etc

and the investors may choose an option depending on their preferences.

Some of the key products of the reliance on mutual funds are as follows:-

1.6 Reliance vision fund:

the primary investment objective of this scheme is to achieve long-term growth of capital by investment

in equity and equity-related securities through a research-based investment approach.

Fund data type: Open-ended equity growth scheme. Date of allotment: 08-oct-1999

Inception date: 08-oct-1995 Minimum investment: Rs 1000

Net asset value as of 30th May 2014: Rs 340.53

Reliance growth fund: the primary investment objective of this scheme is to achieve long-term growth of capital by investment in equity and equity-related securities through a research-based investment approach.

Fund data type: Open-ended equity growth

scheme. Date of allotment: 08-oct-1995

Inception date: 08-oct-1995 Minimum investment: Rs 1000

Net asset value as of 30th May 214:Rs 612.67

Reliance small cap fund: the primary

investment objective of the scheme is to generate long-term capital appreciation by investing predominantly in equity and equity-related

instruments of small-cap companies

and the secondary objective is to generate consistent returns by investing

in debt and money market securities.

Fund data type: An open-ended equity

scheme. Date of allotment: 16 Sep 2010

Inception date: 21 Sep 2010 Minimum investment: Rs 5000

Net asset value as of 30th may 2014: Rs 16.43

Reliance equity opportunities fund:

the primary investment objective of the scheme is to generate long term capital appreciation and provide long term growth opportunities by investing

in a portfolio constituted of equity securities and equity related securities

and the secondary objective is to

generate consistent returns by investing in debt and money market securities.

Fund data type: Open-ended diversified equity scheme

Date of allotment: 28 march 205

Inception date: 30 march 2005

Minimum investment: 5000

Net asset value as of 30th May 2014: Rs 56.40

Reliance on regular saving fund - debt option: the primary investment objective is to generate optimal returns consistent with a moderate

level of risk. The income may be complemented by the capital appreciation of the portfolio. Accordingly, investments

shall predominantly be made in debt and money market instruments.

Fund data type:

open ended open-ended scheme Date of allotment: 08 June 2005

Inception date: 09 June 2005 Minimum investment: Rs 500

Net asset value as of 30th May 2014: Rs 17.49.

Reliance mutual funds in Bangalore have three functional units, they are following:

· Financial functional unit

· Marketing functional unit.

· Operational functional unit.

1.1

ORGANISATIONAL HIERARCHY

Reliance follows the functional structure where the company is divided into segments/separate units based on the functions or roles such as human resources, sales and distribution, and operations. All the similar actives of the company are put into different departments and each of the departments is headed by the department head and these departmental heads have authority chief directly in case of any failure or loss. The functional structure offers a number of potential advantages as well as disadvantages.

Advantages:-

· Specializations / favourable impact on employees:

An advantage of a functional organisational structure is that it offers a high level of specialization. Each unit operates as a

type of self-contained mini-company, changed with carrying out its specific role. Employees typically start their

careers in an entry-level position within

the function and develop specialized knowledge as they move up within the

hierarchy. They become experts within

their functional area, and the unit and company benefit from their expertise

and experience over time.

·

Efficiency and productivity / favourable impact on employees:

A worker who is an expert in his functional area can

perform tasks with a high level of speed and

efficiency, which enhances productivity. Workers who know their jobs well can

proceed with confidence and with a

minimum amount of mistakes. Because the career

paths within the functional unit are

clear, the employees may be highly motivated to advance their careers by reaching the next rung on the ladder, which may

also make them more productive.

Disadvantages:-

· Lack of teamwork:

While specialized units within the functional structure

often perform with a high level of efficiency,

they may have different working well with others units. If a project calls for several units to work together, units may

become territorial and unwilling to cooperate with each other. In essence, each unit may act in what it perceives

to be its own best interest instead

of those of the organization as a whole. Infighting may cause projects to fall

behind schedule.

·

Difficult management control:

Another potential disadvantage of the functional

organization structure is that it can pose a

challenge for top management to maintain control

as the organization expands. As organizations get larger and top management needs to delegate

more decision-making responsibilities in each functional area, the degree of autonomy may also increase, making coordination of activities more difficult.

1.8 ORGANIZATIONAL STRUCTURE

1.1 PRODUCT PROFILE

A. Equity Schemes:-

a. Reliance Equity Fund:

(An open-ended diversified Equity Scheme) The primary

investment objective of the scheme is

to seek to generate capital

appreciation & provide long-term

growth opportunities by investing in a portfolio constituted of

equity & equity-related securities of top 100 companies by market capitalization & of

companies that are available in the derivatives segment from time to time and the secondary objective

is to generate consistent returns by investing in debt and money market

securities.

b. Reliance Tax Saver (ELSS) Fund:

(An Open-ended Equity Linked Savings Scheme.) The

primary objective of the scheme is to generate

long-term capital appreciation from a portfolio that is invested predominantly

in equity and equity-related instruments.

c. Reliance Equity Opportunities Fund:

(An Open-Ended Diversified Equity Scheme) The primary investment objective of the scheme is to seek to generate capital appreciation & provide long-term growth opportunities by investing in a portfolio constituted of equity securities & equity-related securities and the secondary objective is to generate consistent returns by investing in debt and money market securities.

d. Reliance Vision Fund:

(An Open-ended Equity Growth Scheme.) The primary

investment objective of the Scheme is to

achieve long-term growth of capital by investment in equity and equity-related

securities through a research-based investment approach.

e. Reliance Growth Fund:

(An Open-ended Equity Growth Scheme.) The primary investment objective of the Scheme is to achieve long-term growth of capital by investment in equity and equity-related securities through a research-based investment approach.

f. Reliance Index Fund:

(An Open Ended Index-Linked Scheme.) The Investment

Objective under the Nifty Plan is to replicate

the composition of the Nifty, with a view to endeavor to generate returns,

which could approximately be the same as that of the Nifty. The Investment Objective

under the Sensex

a. Reliance NRI Equity Fund:

(An open-ended Diversified Equity Scheme.) The Primary investment objective of the scheme

is to generate optimal returns by investing in equity or equity related

instruments primarily drawn from the Companies in the BSE 200 Index.

B. Debt Schemes:

a. Reliance Monthly Income Plan:

(An Open Ended Fund Monthly Income is not assured &

is subject to the availability of distributable

surplus) The primary investment objective of the Scheme is to generate regular income in order to make regular dividend

payments to unitholders and the secondary

objective is the growth of capital. Primarily the investment shall be made

in debt and money market securities (i.e. 80%) with a small

exposure (i.e. up to 20%) in equity.

b. Reliance Gilt Securities Fund - Short

Term Gilt Plan & Long Term Gilt Plan:

Open-ended Government Securities Scheme) the primary objective of the Scheme is to generate optimal credit risk-free returns

by investing in a portfolio of securities issued and guaranteed by the Central Government and State Government

c. Reliance Income Fund:

(An Open-ended Income Scheme) The primary objective of

the scheme is to generate optimal returns

consistent with moderate levels of risk. This income may be complemented by the capital appreciation of the

portfolio. Accordingly, investments shall predominantly be made in Debt & Money Instruments.

d.

Reliance Medium Term Fund:

(An Open End Income Scheme with no assured returns.) The

primary investment objective of the

Scheme is to generate regular income in order to make regular dividend payments

to holders and unit holders and the secondary

objective is a growth of capital.

a. Reliance Short Term Fund:

(An Open End Income Scheme)

The primary investment objective

of the scheme is to generate stable returns for investors with

a short investment horizon by investing in Fixed Income Securities of short-term maturity.

a. Reliance Liquid Fund:

(Open-ended Liquid Scheme). The primary investment

objective of the Scheme is to generate optimal

returns consistent with moderate levels of risk and high liquidity. Accordingly, investments shall predominantly be made in Debt and Money Market

Instruments.

b. Reliance Fixed Term Scheme:

(Close-ended Income Scheme) The primary objective of the

Scheme is to seek to achieve regular

returns/growth of capital by investing in

a portfolio of fixed income securities normally

maturing in line with the time profile of the plan with the objective of

limiting interest rate volatility.

c.

Reliance Floating Rate Fund:

(An Open End Income Scheme) The primary objective of the

scheme is to generate regular income

through investment in a portfolio comprising substantially of Floating Rate

Debt Securities (including floating

rate securitized debt and Money Market Instruments and Fixed Rate Debt Instruments swapped for floating

rate returns). The scheme shall also invest in

fixed-rate debt Securities (including fixed-rate securitized debt, Money

Market Instruments and Floating

Rate Debt Instruments swapped

for fixed returns.

d. Reliance NRI Income

Fund:

(An Open-ended Income scheme) The primary investment objective of the Scheme is to generate optimal returns consistent with moderate levels of risk. This income may be complemented by the capital appreciation of the portfolio. Accordingly, investments shall predominantly be made in debt Instruments.

e. Fixed Maturity Fund - Series I: Reliance

(A Close Ended Income Scheme)The primary investment

objective of the Scheme is to seek to

achieve regular returns/growth of capital by investing in a portfolio of

fixed income securities normally

maturing in line with the time profile of the Plan with the objective of limiting

interest rate volatility.

f.

Reliance Fixed Maturity Fund -

Series II:

(A closed-ended Income Scheme) The primary investment

objective of the Scheme is to seek to

achieve growth of capital by investing in a portfolio of fixed income

securities normally maturing in line with the time profile of the respective plans.

g. RELIANCE REGULAR SAVINGS FUND:

(An Open-ended scheme)

The Investment Objectives:-

Debt Option: The primary investment objective of this plan is to generate optimal

returns consistent with a moderate level of risk. This income may be complemented by the capital appreciation of the portfolio. Accordingly, investments shall

predominantly be made in Debt

& Money Market

Instruments.

Equity Option: The primary investment objective is to seek capital appreciation and

or consistent returns by actively

investing in equity / equity-related securities.

Hybrid Option: The primary investment objective is to generate a consistent return by investing

a major portion in debt & money market securities and a small portion in equity & equity-related instruments.

Sector Specific Schemes

Sector Funds are specialty funds that invest in stocks

falling into a certain sector of the economy.

Here the portfolio is dispersed or spread across the stocks in that particular

sector. This type of scheme is ideal

for investors who have already made

up their minds to confine risk and return to a particular sector.

Reliance Banking Fund

Reliance Mutual Fund has an Open-Ended Banking Sector

Scheme which has the primary investment

objective to generate continuous returns by actively investing in equity/equity-related or fixed income securities

of banks.

Reliance Diversified Power Sector

Fund

Reliance Diversified Power Sector Scheme is an Open-ended Power Sector Scheme. The primary investment objective of the Scheme is to seek to generate consistent returns by actively investing in equity / equity-related or fixed income securities of Power and other associated companies.

Reliance Pharma Fund

Reliance Pharma Fund is an Open-ended Pharma Sector

Scheme. The primary investment objective

of the Scheme is to generate

consistent returns by investing in

equity-related or fixed-income securities of Pharma and other associated companies.

1.1

Reliance Media & Entertainment Fund

Reliance Media & Entertainment Fund is an Open-ended

Media & Entertainment sector scheme.

The primary investment objective of the Scheme is to generate consistent

returns by investing in equity /

equity-related or fixed income securities of media & entertainment and other associated companies.

1.2

Functional departments.

Functional areas of the Reliance

Industry Ltd. Mutual

fund Bangalore

1. FINANCING DEPARTMENT

2.

SALES DEPARTMENT

3. HUMAN RESOURCE DEPARTMENT

Finance department

Finance is the lifeblood of business. Finance is the

base of all corporate activities in the day-to-day world. Management of finance is broadly concerned with the acquisition and

use of funds by a business firm.

Reliance mutual fund has a very efficient Finance

Department headed by Manager Finance. All

the Finance Department staffs are professionals. The finance department consist of

a team of professionals headed by the Manager Finance, having sufficient industry

experience in the field of accounting, costing,

taxation, company law, and

financial management

OBJECTIVES OF THE FINANCE DEPARTMENT

1. To manage & account

for the financial

resource of the organization, forecast its requirement in the future

and plan accordingly, and check for deviation.

2. Report the financial performance of the organization, to comply with the government rules and regulations.

1.3

FUNCTIONS OF THE FINANCE DEPARTMENT

The main functions

of the finance department are defined as follows:-

1.

Recording of day-to-day business transactions.

2.

Receiving payments from customers and accounting for these funds.

3. Preparations of sales budgets

and revenue budgets and expenditure budgets on a quarterly basis.

4.

Preparations of fund flow and cash flow statement for every month.

5.

Preparing and filing quarterly and final income tax returns.

6.

Preparations and implementation of cost reduction

and cost control methods.

7.

Conduct and coordinate internal and stationary audits.

8. Perpetual stock verification and asset evaluation.

1.4

JOB DESCRIPTION OF PEOPLE

IN FINANCE DEPARTMENT Responsibility of people in the finance department

Establishing and controlling the financial systems

and administrative services

of the organization, and providing

financial information to the Board of Directors.

MANAGER (FINANCE)

Main duties

·

Directing the establishment of financial/accounting principles, procedures, and practices in line with legal and corporate requirements.

·

Ensuring accurate and timely

financial reports and forecasts for the whole

organization so as to provide

a clear insight into its financial condition.

·

Ensuring that the profits of the organization are protected through

the establishment of effective

financial controls; implementing and maintaining appropriate management accounting and reporting systems, budgetary controls,

and expenditure procedures.

1.5

ADMINISTRATIVE OFFICER

(FINANCE) Main duties

·

Providing accurate and timely

financial reports and forecasts and general accounting and administrative services.

· Ensuring effective costing and contribution analysis.

· Implementing policies

to ensure the security of funds and assets.

CASHIER

Main duties

· Maintain an awareness of all promotions and advertisements.

·

Accurately and efficiently ring

on registers and accurately maintain all cash and media at the registers.

· Communicate customer requests to top management.

INTERNAL AUDIT

The audit of all branch

office departments of the corporation is completed every year financial year. In keeping with the practice of improving our

systems and procedures through the use

of IT as a tool, audit packages are being used so that our auditors are able to

carry out the audit in a Front End Applications package environment.

INSPECTION

The inspection of all the branches of the corporation in

India is completed within the time schedule.

Implementation of inspection package in all our offices led to transparency by online report writing,

acceptance of compliance, and closure

process.

VIGILANCE

Special efforts were made to focus on the disposal of

vigilance cases pending for more than one year.

Besides expediting the disposal of vigilance cases, emphasis is also laid on

preventive vigilance through

the dissemination of information on areas susceptible to vigilance.

NOMINEE DIRECTORS

The corporation appoints nominee directors on the board

of the companies where it has a substantial stake by way of debt or

equity. Nominees are officials of the corporation who are in service or retired. Adequate systems

are in place to review and guide the nominee directors from time to time. Nominee directors provide feedback with

regard to operations problems, prospects, corporate governance standards, etc.

RISK MANAGEMENT

The corporation is the largest institutional investor in the

financial market and its staggering fund size

which is placed in varying asset classes is exposed to various financial risks.

To mitigate the investment risks

arising out of market risk, credit risk, interest rate risk and other risks inherent in the financial market, a

distinct full-fledged Risk management structure has been created in the corporation.

BOARD MEETINGS

Board meetings as per regulations are generally held

once in three months. In addition to policy matters,

the board provides

strategic direction for execution ensures

financial discipline and

accountability to the policyholders, and also ensures the interest of the policyholders and stakeholders.

1.6 Sales

Sales management is a business discipline that is

focused on the practical application of sales

techniques and the management of organizational sales operations. It is an

important business function as net

sales through the sale of products and services and resulting profit drive most commercial businesses. These are also typically

the goals and performance indicators of sales management. The art of meeting the sales targets

effectively through meticulous

planning and budgeting refers to sales management. Sales Management helps to extract the best out of employees and

achieve the sales goals of the organization in the most effective ways.

Process of Sales Management

· Sales Planning

·

Marketers must plan things

well in advance for the best results.

It is essential to have concrete

plans. Mere guess works

do not help in business.

·

Know the product well. Sales

professionals must know the benefits of the product for the consumers to believe them.

· Identify the target market.

·

Sales Planning makes the products available

to the end-users at the right

time and at the

right place.

·

Sales Planning helps marketers to analyze the customer demands

and respond efficiently to fluctuations in the market.

· Devise appropriate strategies to increase

the sales of the products.

Sales Reporting

· Sales strategies are implemented in this stage.

·

Check the effectiveness of the various

strategies. Find out whether they are bringing

the desired results or not.

·

Ask the sales team to submit

reports of what they have done throughout the week. The management must sit with the sales

team frequently to assess their performance and chalk out the future courses of action.

Sales Process

·

Sales process refers to various activities which help in the timely achievement of sales targets

for the successful functioning of an organization.

·

Sales Process includes various

strategies and techniques employed by an individual to achieve

sales goals within the stipulated time frame.

·

MANAGER (SALES)

The sales manager is the typical title of someone whose role

is sales management. The role typically involves

sales planning, human resources, talent development, leadership, and control of resources

such as organizational assets.

Main duties

· Manage and coordinate all marketing, advertising, and promotional staff

and activities

·

Conduct market research to determine

market requirements for existing and future products

· Analysis of customer research,

current market conditions, and competitor information

· Develop and implement marketing

plans and projects

for new and existing products.

1.7 MARKETING ACTIVITIES IN RELIANCE MUTUAL FUND PRODUCT DEVELOPMENT

In a competitive market, there is a greater need to

provide insurance products that meet the needs

of customers RMF therefore a wide variety of products that fulfill the needs

of different segments of the society.

As of the end of the financial year 2009-10, the corporation had 54 plans available for sale.

FIELD PERSONNEL TRAINING (FPT)

The theme of FPT is professionalism. For this purpose,

training in a big way is conducted across all zones

using reputed International / National

Training Institutions.

BANKASSURANCE &

ALTERNATE CHANNELS

Bank assurance is the term used to describe the partnership or relationship between a bank and an insurance company whereby the insurance company uses the bank sales channel in order to sell insurance products.

DIRECT MARKETING

This vertical is started with the objective of “creating

new systems for business generation, sales

process monitoring, and business processing with a view to reach out to untapped markets and provide improved

buying experience to customers.”

In a short period, the channel has expanded and professionally trained

Direct Sales Executives (DSEs) to provide financial advice

to prospective customers.

The main focus of the channel was setting up systems and

processes. A state of art lead management

system has been established to provide easy access to prospective customers to reach out to LIC to buy a policy. Such leads are captured

through our website.

www.reliancemutualfund.com is passed on to well-trained DSEs on real-time basis who can contact

the customer instantly.

AGENTS

Most people have their first contact with an insurance

company through an insurance sales agent.

These workers help individuals, families, and businesses select insurance

policies that provide the best protection for their lives, health, and property. Insurance

sales agents are commonly

referred to as “producers”

in the insurance industry.

Agency Strength

The total number

of agents in our role is 140280 as of 31.03.2011 as against

134485 as of 31.03.2012.

a) Agents’ Club Membership In order to motivate and recognize high performers amongst

agents a premium

club called the Corporate Club. The

other 5 clubs were formed to recognize

agents, who perform

consistently year after year.

MEMBERS OF VARIOUS AGENTS CLUBS

|

Name of the Club |

|

Corporate |

|

Chairman |

|

Zonal Manager |

|

Divisional Manager |

|

Branch Manager |

|

Distinguished Agents |

a) Career

Agents Scheme

The corporation has a scheme of Urban Career Agents and Rural Career

Agents to promote the cause of professionalizing

the agency force. They are given Stipends at the

start of their career to enable them to settle down in the profession.

a)

Chief mutual fund Advisor

Scheme

The corporation introduced the above scheme with the

objective of increasing its market presence through more agents by utilizing the capabilities of existing high-performing agents for organizational growth.

b)

Authorised Agents

In tune with the increasing customer expectation j select agents collect the renewal premium through “Premium Points”.

1.8

HR DEPARTMENT

For any business to run one needs four M’s namely Man,

Money, Machine, and Material. Managing

other three resources other than men,

are easy to handle. Men are very difficult to

handle because no two human beings are similar in all ways. Human beings

can think, feel and give responses.

Handling humans is more important for any business because human beings have crucial potential that may be very

profitable for the business. And this potential can be developed to an unlimited extent if they are

provided with the proper environment. So the function

of managing men is as important as the finance or marketing function

in any business.

HRM refers to practices and policies framed

for the management of human resources in an

organization, including Recruiting, screening, rewarding, and appraising. “Human

resources have at least two meanings depending on context. The original

usage derives from political economy and economics, where it was traditionally called

lab our, one of three factors of production.

The more common usage within corporations and businesses refers to the

individuals within the firm, and to

the portion of the firm's organization that deals with hiring, firing,

training, and other personnel issues.

This article addresses both definitions.

1.9 HR STRUCTURE CORPORATE HR:

Activities taken up by Corporate

HR are:

· Policymaking

· Implementing suggestions - HEWITT CONSULTANT

· Strategic planning.

ENTITY HR:

· Activities taken

up by Entity HR are :

· Execution of policies and practices

· Targets for recruitment of Circle HR.

PRESIDENT HR CORPORATE HR ENTITY HR CIRCLE HR CEO

CIRCLE HR:

Activities taken up by Circle HR are:-

· Recruitment

· Appointment

· Training

· Payroll

· Employees issues

HR FUNCTIONS

· Talent

acquisition

· Talent development

· Performance management system

· Training

· Carrier planning

· Suggestion planninh

TALENT MANAGEMENT

Operation HR RECRUITMENT PROCESS

STEP 1: MANPOWER PLANNING

AOP (Annual Operating Plan), this process is taken up

every year. It is taken up at Personal Level and Entity Level. Several points like

Revenue generation, Acquisition number, etc.

STEP 2: SOURCING ACTIVITY

There are three types of sourcing done at Reliance.

After candidates are chosen then the same is sent to the department head where the vacancy arises. The department

head will then shortlist the same and they ask the HR department to fix

an interview with the selected

candidates. There is two types of interview which is taken up at Reliance,

firstly the Functional interview, and then the Functional Head and HR Head takes the interview.

INTERNAL source

Employee Reference

Re-employment of former

employee EXTERNAL SOUCING

Placement Consultant – Ruchika,

the Age, the Avenue. Job Portals - Monster, NAUKRI.

Campus Recruitment

STEP 3: APPROVAL.

The HR executives will negotiate the CTC with the candidate. Then after it is

sent to ECRC

Then the same is sent to CRL

The same is then sent to Management for SAP Applicant Code.

CHAPTER-2

OBJECTIVES, SCOPE, AND RESEARCH METHODOLOGY

2.1 RESEARCH METHODOLOGY

Research Methodology is a way to systematically solve the

research problems. It involves adopting

various methods and techniques which are best suited for the research and study

of the problem, for investigation and

analysis of the problem starts with data collection from various sources i.e. primary and secondary

sources, data analysis and interpretation, and finally the finding. The research methodology comprises two

Research + Methodology.

Research methodology is a way to solve the problem scientifically and systematically. It basically includes the selection of various methods and techniques in the research conducted.

2.2 NEED FOR THE STUDY

The main

purpose of doing this project was to

know about mutual funds and customer satisfaction This also helps to know in

detail about various mutual fund

schemes and also the performance of various mutual fund schemes

It also helps in

understanding how a fund is being designed

It also helps in

understanding whether a Sales manager's

decisions and strategy

also affect the customer satisfaction

RESEARCH OBJECTIVES:

· The study level of satisfaction of customers towards

Reliance Mutual Fund.

·

To find the customer’s preference

for various options available in Reliance Mutual Fund.

· To know the kind of benefits people expected

from Reliance Mutual Fund.

SCOPE OF THE STUDY

The study urges to know the customer

satisfaction, current market trend and performance and also to improve the existing services and to add on anything

if required the study also helps to understand risk and hence informed about investment decisions

for better performance of the company.

Research Design

The research design is a pattern or an outline of a research project.

It is a statement of only the essence of a study that provides

the basic guidelines for the detail of the project.

Research design stands for advance

planning of the method to be used in their analysis,

keeping in view the objective of the research and availability of staff, time and

money.

Sample Technique

The sampling procedure refers to the technique which is used in selecting the items for the sample infect; this technique of procedure stands for the sample design itself. The sampling procedure for the study is convenient sampling.

2.3 DATA COLLECTION

There are several ways of collecting the appropriate data which differ considering in the context of money, costs, time, and other resources data can be collected through different sources.

Primary data

Primary data was collected through a survey method by distributing questionnaires to the different customers of reliance on mutual funds in the Bangalore branch

Secondary data

The secondary data collection includes a collection of data through sources like

1. Fund facts sheets of different AMC that are considered for the analysis

purpose

2. The NAVs

are taken from AMFI & websites of the AMC under consideration

3. From record,

report, magazine, and websites or RMF.

2.4 IMPORTANCE OF THIS STUDY

Ø Every

person who has no knowledge about investment can easily invest in mutual funds

Ø One of the mode of investing

in mutual funds

is SIP’s systematic investment plan is less risky to invest and every investor wants to invest on less price.

Ø

Mutual fund is totally dependent

on NAV [net asset value]

Ø Comparatively investors

have limited risk since the

investments are managed

by the highly experienced and qualified fund manager

Ø The

primary investment objective of the Scheme is to achieve long-term growth of capital

by investing in equity and equity-related securities through a research-based investment approach. However,

there can be no assurance

that the investment

the objective of the Scheme will be realized,

as actual market movements may be at variance

with anticipated trends.

Ø This study helps to know about the level of customers satisfaction and whether distributors are happy with the performance of Reliance Mutual Funds

LIMITATIONS OF THE STUDYØ

![]() ØTime constraints: due to

less availability of time it may be possible that all the related aspects

May not be covered in the project.

ØTime constraints: due to

less availability of time it may be possible that all the related aspects

May not be covered in the project.

ØAnalysis is done with the limited availability of the data

CHAPTER-3

DATA ANALYSIS AND INTERPRETATION

3.1 DATA ANALYSIS AND INTERPRETATION

CLASSIFICATION OF RESPONDENTS ON THE BASIS OF

AGE

Table no 3.1

|

Serial no. |

Age group |

No. of respondent |

percentage |

|

1. |

18-25 |

22 |

22 |

|

2. |

25-23 |

32 |

32 |

|

3. |

35-45 |

28 |

28 |

|

4. |

45 & above |

15 |

18 |

|

|

Total |

100 |

100 |

Source: Data collected through questionnaire method

Fig 3.1

INTERPRETATION

Hence it is concluded that the majority of respondents 32 percent are in the age group of 25-35 years.

3.2. CLASSIFICATION OF RESPONDENTS ON THE BASIS OF

AWARENESS

|

Sr. No |

Response |

No.of respondents |

Percentage |

|

1 |

Yes |

30 |

60 |

|

2 |

No |

20 |

40 |

|

|

Total |

50 |

100 |

INTERPRETATION

Hence it is concluded that the majority of respondents i.e. 60% of respondents are aware of reliance on mutual funds.

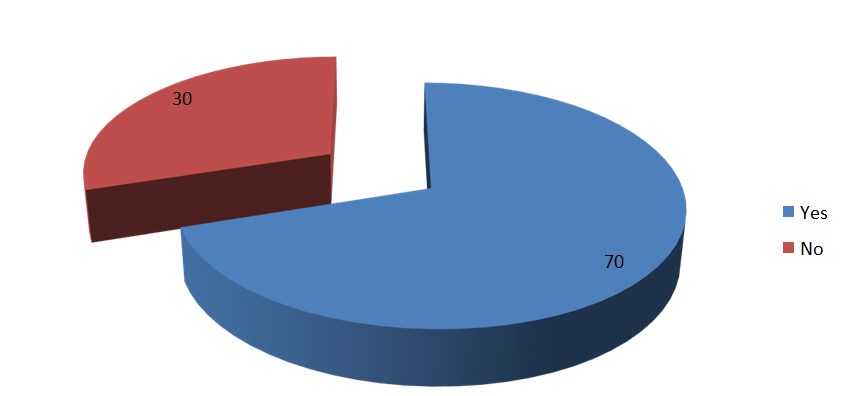

3.3. CLASSIFICATION OF RESPONDENTS ON THE

BASIS OF HIGHLY VOLATILE MARKET, DO YOU THINK MUTUAL

FUNDS ARE THE DESTINATION FOR INVESTMENT?

|

Sr.NO |

Response |

No. Of respondents |

Percentage |

|

1 |

Yes |

35 |

70 |

|

2 |

No |

15 |

30 |

|

|

Total |

50 |

100 |

INTERPRETATION

Hence it is concluded that the majority of respondents i.e. 70% of respondents think mutual funds are the destination for investment.

3.4. CLASSIFICATION OF RESPONDENT OF THE BASIS OF Satisfy With The Different Types Of Products And Services Provided By Reliance Mutual Funds?

|

Sr. No |

Response |

No. of respondents |

Percentage |

|

1 |

Yes |

40 |

80 |

|

2 |

No |

10 |

20 |

|

|

Total |

50 |

100 |

INTERPRETATION

INTERPRETATION

Hence it is concluded that the majority of respondents i.e. 80% of respondents satisfy

with the different types of

products and services.

3.5. CLASSIFICATION OF RESPONDENTS ON THE

BASIS OF INVESTING MONEY, WHICH FACTORS DO YOU PREFER MOST?

|

Sr. No. |

Response |

No. of respondents |

Percentage |

|

1 |

Liquidity |

15 |

30 |

|

2 |

Low risk |

16 |

32 |

|

3 |

High return |

9 |

18 |

|

4 |

Company reputation |

10 |

20 |

|

|

Total |

50 |

100 |

INTERPRETATION

Hence it is concluded that the majority of respondents i.e. 32% of respondents prefer the liquidity factor.

3.6.

CLASSIFICATION OF RESPONDENTS ON THE BASIS OF EVER INVESTED

IN MUTUAL FUNDS?

|

Sr. No. |

Response |

No. of respondents |

Percentage |

|

1 |

Yes |

30 |

60 |

|

2 |

No |

20 |

40 |

|

|

Total |

50 |

|

INTERPRETATION

Hence it is

concluded that the majority of respondents i.e. 60% respondents invested in mutual

funds. |

3.7. If yes, which type of

funds of mutual

funds do you want to invest

|

Sr. No. |

Response |

No. of respondents |

Percentage |

|

1 |

Fixed deposit |

16 |

32 |

|

2 |

Mutual funds |

4 |

8 |

|

3 |

Equities |

10 |

20 |

|

4 |

Others |

20 |

40 |

|

|

Total |

50 |

100 |

INTERPRETATION

Hence it is concluded that the majority of respondents i.e. 40% of respondents invest

in other types of

investments.

3.8. What ARE THE PRIMARY SOURCES OF YOUR KNOWLEDGE ABOUT MUTUAL FUNDS AS AN INVESTMENT

OPTION?

Corresponding to your

choice how would you

rate their influence on your final mutual funds' purchase

decisions? 1 is the lowest and 5is the highest

rating

|

Sr. No. |

Sources |

No.of respondents |

Percentage |

|

1 |

Television |

30 |

60 |

|

2 |

Internet |

6 |

12 |

|

3 |

Newspaper |

4 |

8 |

|

4 |

Friends |

5 |

10 |

|

5 |

Sales |

5 |

10 |

|

|

Total |

50 |

100 |

INTERPRETATION

Hence it is concluded that the majority of respondents i.e60% of respondents influence by television.

3.9. CLASSIFICATION OF RESPONDENTS ON THE BASIS OF HOW YOU RATE

THE RISK ASSOCIATED WITH MUTUAL FRIENDS?

|

Sr. No. |

Response |

No. of respondents |

Percentage |

|

1 |

Low |

10 |

20 |

|

2 |

High |

30 |

60 |

|

3 |

Moderate |

10 |

20 |

|

|

Total |

50 |

100 |

INTERPRETATION

Hence it is concluded that the majority of respondents i.e60%

of respondents associated with high risk in mutual funds.

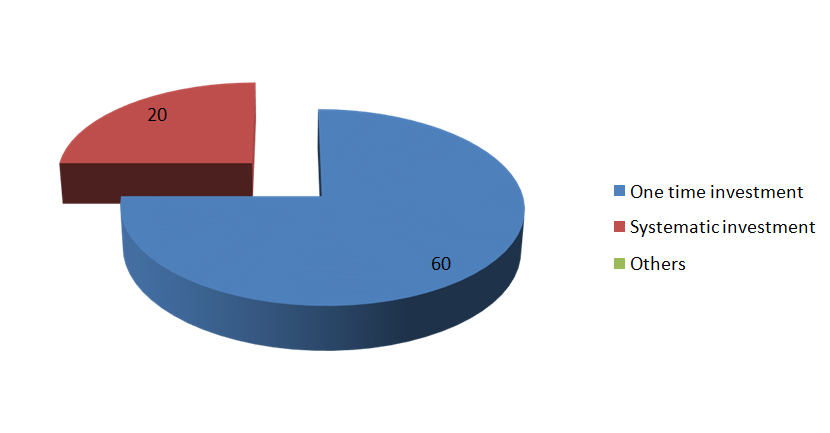

3.10. CLASSIFICATION OF RESPONDENTS ON THE

BASIS OF WHEN YOU INVEST IN MUTUAL FUNDS WHICH MODE OF INVESTMENT WILL YOU PREFER?

|

Sr. No. |

Response |

No. of respondents |

Percentage |

|

1 |

One time investment |

30 |

60 |

|

2 |

Systematic investment |

10 |

20 |

|

3 |

Others |

10 |

20 |

|

|

Total |

50 |

100 |

INTERPRETATION

Hence it is concluded that the majority of respondents i.e60% of respondents invest in one time in investment.

3.11. CLASSIFICATION OF RESPONDENTS ON THE BASIS OF IN WHICH MUTUAL

FUNDS YOU HAVE INVESTED?

|

Sr. No. |

Response |

No. of respondents |

Percentage |

|

1 |

SBIMF |

20 |

40 |

|

2 |

UTI |

10 |

20 |

|

3 |

RELIANCE |

10 |

20 |

|

4 |

HDFC |

10 |

20 |

|

|

Total |

50 |

100 |

INTERPRETATION

Hence it is concluded that the majority

of respondents i.e40% of respondent invest in SBIMF.

CHAPTER-4

FINDINGS, CONCLUSION & SUGGESTIONS

4.1 FINDINGS

67% of the respondent's rate performance of RMF is Very

Good, 27% rate excellent, and 6% rate Good . The majority of the respondents rate the performance of RMF as very good. (Table no. 2)

1. According

to the analysis, 57% of the respondents are satisfied by services provided by RMF,23% are neither satisfied nor

dissatisfied, 17% very satisfied, and 3% are

dissatisfied. The majority of the

respondents rate the services provided

by RMF as Good

(Table no. 3)

2. All the respondents tell Yes that RMF has a good impact as compared to other AMC in MF industry.

(Table no.5)

.4.87% of the respondents tell that RMF is very helpful

in analysing & making right choice of investments

to the investors, 13% tell To some extent. Majority of the respondents tell Yes RMF is very helpful in analysing &

making right choice of investments to the investors. (Table no. 6)

5. 73%

of the respondents feel that while taking a investment decision Performance

matters a lot, and 23% Consistency is

considered Majority of the respondents feel that while taking a decision

Performance matters a lot.

6.According to the rating, 43% of the respondents rate the equity performance of RMF in long run is Excellent, 40% rate it Very Good, and 17% rate it as Good.43% of the respondents rate the equity performance of RMF in long run is Excellent (Table no. 8)

4.2

CONCLUSION

The research shows that Equity Funds are performing well, but the investments from investors are less

in equity funds, because

of unawareness about mutual funds.

Therefore company has to take some steps to make aware

people of Mutual Funds, through advertisements

in Newspaper, Magazine, Commercial advertisement, distributing leaflets, Television, Radios. And I came for following conclusion

:

·

All the workers and staff work together to increase the organization’s profit

and thereby to increase its growth, each department works without any failures.

· Very less people

knows about the service of Reliance.

·

Managing complex business processes is one of the important

management challenges of this new century. Moreover,

globalization and technological advancement are driving changes in all sectors. In reliance organisational

structure and management style are playing an important role in Information Technology Management.

·

Structure is influenced by the external

environment in which the business operates

as well as its culture and the nature of the work

and activities it undertakes.

· The structure can have both a positive

and negative impact on a business.

·

Having the right structure

allows a business

to respond and adapt to changes

in the market quickly.

· The company

needs to adopt new strategy’s to have an efficient departments

. The

organization is following highly appreciable managerial practices, which made

it possible to the organizational

goals more easily. The HR policies set by the company are remarkable. Satisfied workers are

considered to be the assets of the organization and they are motivated enough to perform well. The

infrastructure facilities are very much impressive. There is a high rate of capacity

utilization. Quality management system is also remarkable.

·

By this study, I was able to

understand how the various functional departments of an organization co-ordinate and work towards achieving the

organizational goals in an effective

and efficient manner. I am sure that

my study at Reliance capital asset management was a success

and hope that it will be an asset for my future.

4.3

SUGGESTIONS

The awareness level of investors is low who are interested in dealing in mutual fund:

· Most of investors are totally unaware about this investment.

· Very less people

knows about the service of Reliance.

· Past image of mutual fund is not good.

·

Reliance can promote the investors by advertising, hording,

and by interviews to invest

in this fund.

·

Most of the investors want to

invest in public co.’s fund just because of safety purpose.

· Most of the investors

want to safer side in investment.

· Most of the investors want to invest in debt funds because those are the risk free funds; it gives the interest on investment.

·

Most of the investors don’t know

about the mutual funds so they want advisory

services from reliance which could provide

them whole information about the market

situation of mutual

fund.

ANNEXURE

BIBLIOGRAPHY

Book:

Ø Research Methodology Methods & Techniques by C R Kothari

Ø Philip Kotler, Gary Armstrong; “Principle of Marketing” Prentice-Hall of India 10th Edition

·

Reliance mutual fund Brochures and Manuals.

· Websites.

·

www.relianceimutualfund.com

·

www.amfi.com

QUESTIONNAIRE

DEAR SIR/MADAM,

I am...........student of MBA semester at..........., I am doing project on “CUSTOMER SATISFACTION TOWARDS RELIANCE MUTUAL FUNDS AT SHIMLA,”. Please give your precious time for filling this detail.

PERSONAL DETAILS:

SECTION – A

a) Name b) Gender

c)Address d) Profession

SECTION - B

1. Are you aware from reliance mutual funds?

a) Yes b) No

2) In this highly volatile market, do you think mutual funds are destination for investment?

a) Yes b) No

3)

Are you satisfied with the different types of products

and services provided

by the reliance mutual funds?

a) Yes b) No

4) While investing your money, which factor you prefer most? Anyone

a) Liquidity b) Low risk

c) High return d) Company reputation

5) Have you ever invested in mutual funds?

a) Yes b) No

6) If yes, in which type of funds of mutual funds you want to invest?

a) Tax saver funds b) Index funds

c) Sectorial funds d) gold funds

7) Which investment do you feel more profitable?

a) Fixed deposit b) Mutual funds

c) Equities d) Other

8)

Which are the primary

sources of your knowledge about mutual funds

as an investment option?

Corresponding to your choice how would you rate their influence on your final

mutual funds purchase decisions? 1 is the lowest and 5 is the

highest rating.

|

|

1 |

2 |

3 |

4 |

5 |

|

Television |

|

|

|

|

|

|

Internet |

|

|

|

|

|

|

Newspaper |

|

|

|

|

|

|

Friends |

|

|

|

|

|

|

Sales |

|

|

|

|

|

10) How do you rate the risk associated with mutual funds?

a) Low d) Moderate

c) High

11) When you invest in mutual funds which mode of investment will you prefer?

a) One time investment

b) Systematic investment plan

12) In which mutual funds you have invested?

a) SBIMF

b) UTI

c) RELIANCE

d) HDFC

e) KOTAK

f) ICICI

g) JM MUTUAL FUNDS

h) Other

Click here to download the office file

![Himachal Pradesh - General Knowledge (H.P.-GK) Important multiple choice questions [MCQ] Series-G [PDF]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEihP5ys_xY1amJSiIEX-cY2NLnL0-9UBNpv2MTUAeFLcs2pnfZKTYrt7Qd-n_r7M4evoPfvEdhHqdfZJOZSq9KYkrGcH_xqghVowGepqKTjk95dgtUVABcsuzhRcsWto5IrCi3jfZcRgnUztoalEsVLXewOeyf2k3keJIRTSQvEIfkRVVhFXlOSAxAK/w72-h72-p-k-no-nu/Untitled.png)

![Himachal Pradesh - General Knowledge (H.P.-GK) Important multiple choice questions [MCQ] Series-E [PDF]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgvoEofOEWgV2ZbKnHN0TIymi5Ri4OkMlEtZSBr-uBeGEIfoHH7VbEK_Znb2bog2mo5eWSYvhgC3VT2gUixmn_it7TP13EVdxDKI21dEHngzbUbjy0myZ6X86bS6IaqkkweK-uwRYQdW3GLNFQtUkWJhmffquskJFEii-4T0hAtUzte3rXwegACr8hy/w72-h72-p-k-no-nu/Series%20E.JPG.webp)

0 Comments